The stock market isn't unstoppable, but comparisons to 1929 are nonsense.

By most indications, the U.S. economy is quite strong. But that hasn’t stopped a number of “experts” from predicting a future full of doom-and-gloom. The most aggressive of these bearish predictions call for a repeat of the 1929 crash that started the Great Depression. In early 2014, investors passed around a chart that seemed to predict imminent disaster.

All of this is, of course, complete nonsense. Any comparisons between 1929 and 2015 are. The economic, monetary, and geopolitical transformations that have taken place during the intervening eight-plus decades have been massive in scope.

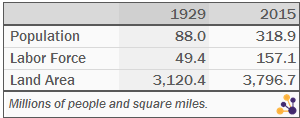

From a sheer size perspective, the U.S. has changed significantly since 1929, when it had a population of about 88 million — roughly the size of Egypt today. Since then, the U.S. population has nearly quadrupled while the labor force has tripled. The physical size has also grown by about 675 million square miles — the size of Germany and Norway combined — through the addition of Alaska and Hawaii.

From a sheer size perspective, the U.S. has changed significantly since 1929, when it had a population of about 88 million — roughly the size of Egypt today. Since then, the U.S. population has nearly quadrupled while the labor force has tripled. The physical size has also grown by about 675 million square miles — the size of Germany and Norway combined — through the addition of Alaska and Hawaii.

Economy Then and Now

The more substantial changes have come in the composition of the U.S. economy. The Dow is a flawed index in many ways, but its transformation does nicely illustrate the extent to which the U.S. economy has evolved. Gone from the index are the tin can manufacturer, cash register company, and grower of sugar; they’ve been replaced by companies that provide cloud computing services and make handheld computers and oncology drugs.

The differences among companies in similar industries are equally substantial. For example, Wright Aeronautical’s XF3W-1 Apache was a bit simpler than the Boeing AH-64 Apache.

The differences among companies in similar industries are equally substantial. For example, Wright Aeronautical’s XF3W-1 Apache was a bit simpler than the Boeing AH-64 Apache.

General Electric (GE), the common component between the two lists, had recently introduced the television when the Depression began. It had not yet introduced its revolutionary electric clothes washer (shown in the adjacent image). The year after the 1929 crash, GE opened its moldable plastics division.

Another noteworthy presence in the Dow of 2015 is UnitedHealth Group, one of several publicly listed health plan stocks, which were generally a foreign concept in the 1920s.

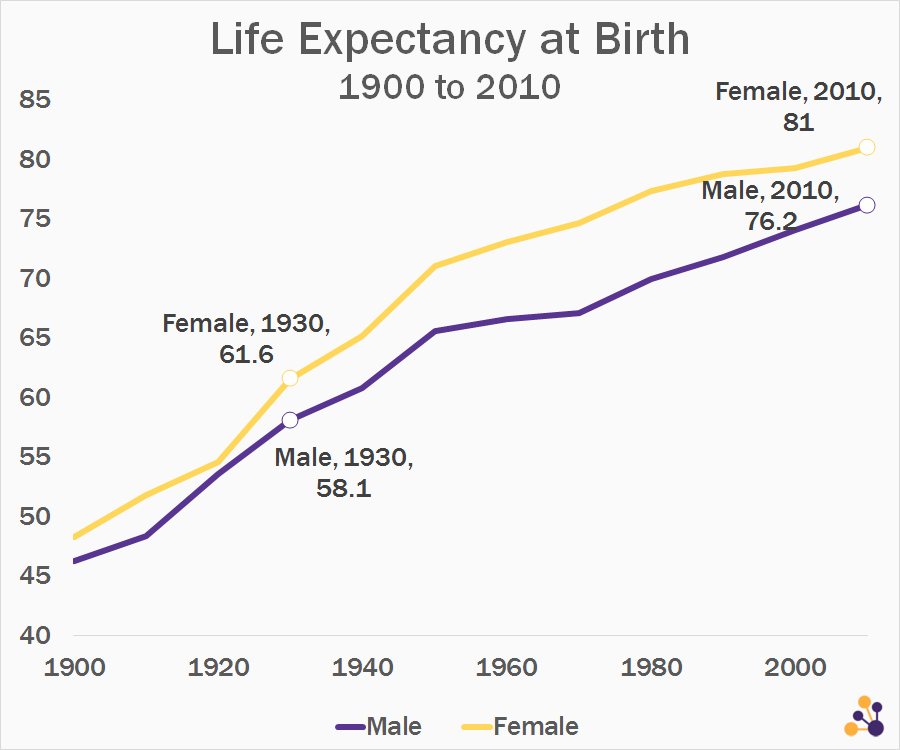

At the time of the Great Depression, men weren’t expected to live much past the age of 58. The lengthy list of individuals who have exceeded that age includes Warren Buffett (85), Bill Gates (59), Larry Ellison (71), and Donald Trump (69). Steve Jobs passed away at the age of 56.

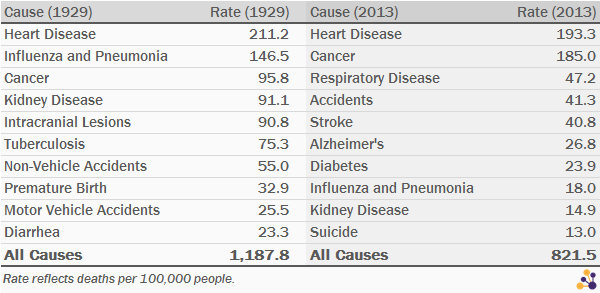

The advances in health care are perhaps better illustrated by comparing the leading causes of death. In 1929, only heart disease killed more Americans than pneumonia, which caused death at the rate of respiratory disease, strokes, diabetes, and Alzheimer’s disease combined in 2013:

New York to Paris

The examples of the technological breakthroughs made since 1929 are numerous. About two years before the Great Depression began, Charles Lindbergh completed his historic transatlanic flight. The trip took about 33.5 hours, though Lindbergh would had arrived sooner had he not circled fishing boats to ask for directions.

The examples of the technological breakthroughs made since 1929 are numerous. About two years before the Great Depression began, Charles Lindbergh completed his historic transatlanic flight. The trip took about 33.5 hours, though Lindbergh would had arrived sooner had he not circled fishing boats to ask for directions.

Today, a Google search for “New York to Paris flight” turns up about 106 million results. Those include more than 150 different daily flights that will take less than eight hours, cost less than $800, and include wireless Internet access.

NYSE Activity

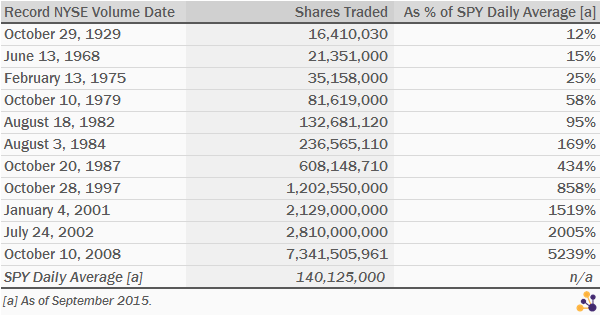

On “Black Tuesday” in October 1929, a record number of shares were traded on the New York Stock Exchange: 16,410,030. In 2015, that volume represents about 45 minutes of trading in the S&P 500 SPDR (SPY).

The following chart shows several record volume days on the NYSE between 1929 and 2015:

In 1929, the NYSE began requiring its members to wear identification badges on the floor. It had not yet adopted a rule requiring independent audits of the financial statements of listed companies. (That happened in 1933.)

Around the World

China is often in the financial headlines in 2015. There is a good reason for that; China is the world’s largest economy and most populous country. And today, there are dozens of China ETFs and China mutual funds to invest in.

That wasn’t quite the case in 1929; China had only recently been reunified under Chiang Kai-shek after 14 years of fighting between regional warlords. About five years after the 1929 crash, the Red Army reorganized under the leadership of Mao Zedong.

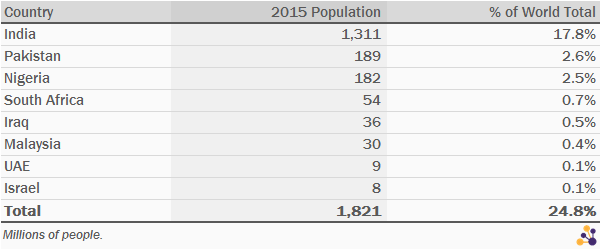

Quite a bit has changed elsewhere in the world as well. When stocks crashed in 1929, India, Nigeria, and Malaysia were British colonies — along with Iraq, Israel, Pakistan, South Africa, the UAE, and many others.

Today, that list of former British colonies includes three of the seven most populous countries in the world:

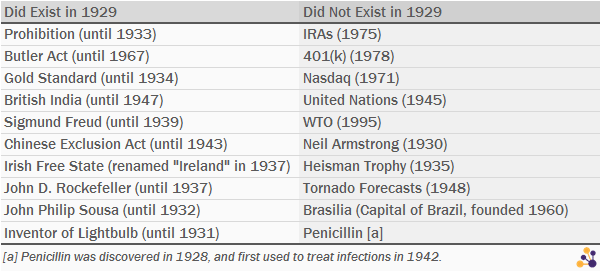

No Booze, No 401(k)

When the stock market crashed in 1929, no damage was done to any IRA or 401(k) accounts; those wouldn’t be established for another 45 years or so. There was also no United Nations or World Trade Organization; those would be founded in 1945 and 1995, respectively.

Several institutions that did exist then have since been replaced. The gold standard was in place on Black Tuesday, as was Prohibition. Virginia had recently passed a series of Racial Integrity Acts that legally defined “white” and “colored” people. In Tennessee, it was illegal to teach evolution in schools (and some teachers had been convicted). The inventor of the light bulb was still alive, and Knute Rockne was the head coach at Notre Dame.

The Next Crash

To be clear, today’s stock market isn’t invincible. In fact, there are some pretty good indications that it may be slightly overvalued by historical standards. Corrections and crashes will be a part of the future. But anyone who tries to tell you that one is imminent by invoking the events of 1929 is probably trying to sell you a newsletter. History does repeat itself, but times also change.

This thought from Josh Brown sums it up nicely:

Anyone can find similarities in the stock market action of different years. It’s not complicated – stocks can really only do some combination of three things, up, down or sideways. But this type of comparative analysis is, as always, a function of what details you choose to leave out. I can compare my house to the Taj Mahal if I choose to leave out quantitative factors like square footage or qualitative factors like its location or historical significance.

This applies to comparisons to the 1999 bubble as well; there may be some similarities, but any attempt to establish a parallel will inevitably leave out significant parts of the story.

About the Author: Michael Johnston

Michael Johnston is senior analyst for ETF Reference, and also serves as COO of parent company Poseidon Financial. His investment expertise has been featured in The Wall Street Journal, Barron’s, and USA Today, among other publications. He resides in Chicago.

Comments