It's probably IAU.

Gold is, to put it mildly, a controversial investment topic. There are plenty gold bugs, and a growing number of those who ridicule them. For those who do want some allocation to gold within a portfolio, ETFs have become a popular way to gain exposure. The 13 Precious Metals ETFs that offer exposure to gold have more than $30 billion in assets.

Finding the best gold ETF is a relatively straightforward endeavor in most cases. Because the underlying asset most investors are seeking — gold bullion — is fairly standard, physically-backed gold ETFs are differentiated primarily by the fees they charge. The physical gold ETF with the lowest expense ratio will also have the best performance.

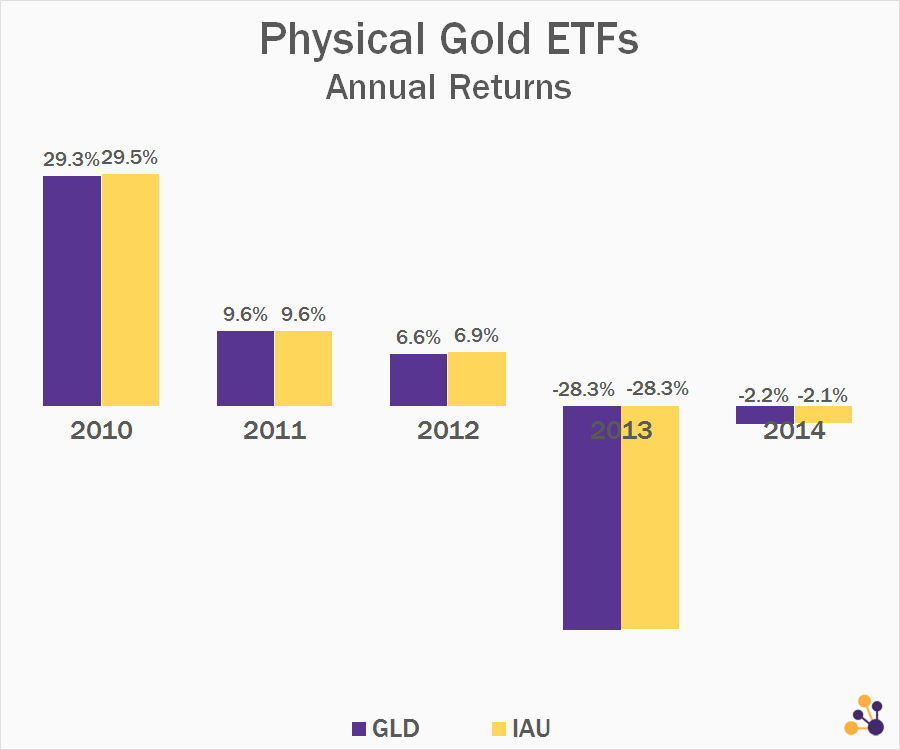

As shown above, the iShares Gold Trust (IAU), which charges 0.25 percent annually, generally performs better than the Gold SPDR (GLD), which charges 0.40 percent.

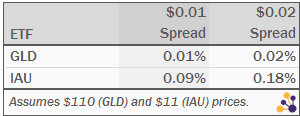

This decision gets slightly more complicated when considering costs associated with trading. Both IAU and GLD are very liquid, with average daily volumes of 2.8 million and 5.6 million shares, respectively. The difference is the price: IAU currently costs about $11 per share, while GLD is closer to $110. So a spread of $0.01 translates into an effective upfront cost of 9 basis points for IAU, compared to just 1 for GLD.

This decision gets slightly more complicated when considering costs associated with trading. Both IAU and GLD are very liquid, with average daily volumes of 2.8 million and 5.6 million shares, respectively. The difference is the price: IAU currently costs about $11 per share, while GLD is closer to $110. So a spread of $0.01 translates into an effective upfront cost of 9 basis points for IAU, compared to just 1 for GLD.

So investors planning to hold the position for only a few months may find GLD to actually be more cost effective despite the higher annual expense ratio. But those looking for longer-term exposure should opt for IAU.

Other Gold ETF Options

While physical gold is a commodity — and thus unable to be differentiated beyond price — several issuers have developed products that combine traditional gold exposure with other strategies. Below is a brief explanation of each, including the the type of investor to which it might appeal:

- ETFS Physical Asian Gold ETF (AGOL) and Physical Swiss Gold ETF (SGOL): These products make sense if you’re concerned about gold stored in U.S. vaults being confiscated. They are more expensive than IAU, and thus will underperform that fund.

- Gold Shares Covered Call ETN (GLDI): This product provides some current income and limit downside by writing call options. But it will have limited upside if gold prices surge, thus removing one of the most common objectives of those considering a gold ETF.

- PowerShares DB Gold ETF (DGL): This product uses futures contracts instead of physical gold, meaning that it could outperform IAU if gold futures are consistently backwardated. But over the long term, it is likely to deliver inferior performance relative to physical gold ETFs.

- AdvisorShares Gartman Gold Yen (GYEN) and Euro (GEUR) Funds: These products offer exposure to gold prices in non-U.S. dollar terms. The currency overlay can make a surprisingly large difference, as shown in the chart below. For investors looking to combine a currency play with gold, these ETFs may be worthwhile — though their higher expense ratios will cause them to underperform absent changes in exchange rates.

All of these products offer creative twists on gold exposure that will perform well in certain environments, but most investors should settle on IAU for long-term exposure.

About the Author: Michael Johnston

Michael Johnston is senior analyst for ETF Reference, and also serves as COO of parent company Poseidon Financial. His investment expertise has been featured in The Wall Street Journal, Barron’s, and USA Today, among other publications. He resides in Chicago.

Comments