In the battle between ETFs and mutual funds, the scale is clearly tipping in favor of ETFs. As the exodus from mutual funds continues, ETFs continue to enjoy strong inflows and increased usage rates from all types of investors. Continue reading →

In the battle between ETFs and mutual funds, the scale is clearly tipping in favor of ETFs. As the exodus from mutual funds continues, ETFs continue to enjoy strong inflows and increased usage rates from all types of investors. Continue reading →

There is little debate over the idea that a buy-and-hold investing strategy will deliver positive results over the long run, and typically outperform the majority of investors who attempt to time ups and downs. Continue reading →

ETFs have been in the headlines quite a bit over the last year -- and often not in a positive light. There have been stories about the SEC killing off leveraged ETFs, a crisis in junk bonds (and related liquidity rules), and even another "flash crash" thrown in for good measure. Continue reading →

There are now more than 1,700 ETFs offering exposure to countless investing strategies. Beyond the obvious benefits to investors, the surge in the number of ETFs creates some interesting opportunities for research and analysis. This article includes seven charts highlighting track records, head-to-head comparisons, and other results that we found interesting. Continue reading →

Among the nearly 2,000 ETFs available to U.S. investors are products with various levels of risk and degree of complexity. Commodity ETFs, which can potentially provide diversification benefits to a portfolio or be used to bet on a short-term movement in natural resource prices, fall toward the high-risk and high-complexity end of this spectrum. Continue reading →

Commodity ETFs have piqued the interest of many investors, especially after a prolonged drop in prices. While some detailed academic research has highlighted the potential benefits, the live track records have generally been disappointing. Continue reading →

During the past decade, interest in commodities as an asset class has increased considerably. Several different factors are likely responsible, including the surge in the number of exchange-traded commodity products (there are now more than 100 ETFs and ETNs offering exposure to commodities). Continue reading →

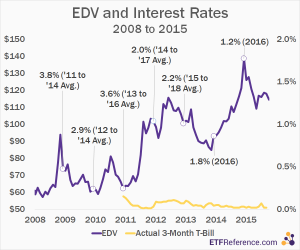

The end of the 2015 calendar year may also mark the end of an era that has lasted far longer than many investors anticipated. Futures markets imply approximately a 72 percent chance that the Fed hikes interest rates in December for the first time since 2010. Continue reading →