If interest rates finally rise in December, an impressive streak for long-term bond ETFs could finally end.

The end of the 2015 calendar year may also mark the end of an era that has lasted far longer than many investors anticipated. Futures markets imply approximately a 72 percent chance that the Fed hikes interest rates in December for the first time since 2010.

A rate hike is meaningful for several reasons, but particularly noteworthy for the impact that a December increase (and future raises) would have on bond prices. As rates rise, prices for outstanding bonds generally decline (since freshly-issued debt becomes more attractive to investors).

By now, the expectation of a rate hike is nothing new. For the last several years, most asset managers and economists have predicted an imminent increase in rates. This “take off” has taken much longer than most have anticipated — and bond funds have performed much better than expected.

Long-Term Bond ETF Performance

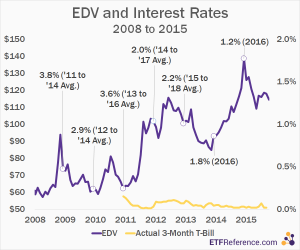

The following chart shows the performance of the Vanguard Extended Duration Treasury ETF (EDV) since its launch in 2008. The annotations on the table indicate projections for 3-month Treasury Bills at various points over this time period, based on the Congressional Budget Office’s annual “Economic Outlook” report (for example, the January 2009 report projected that the 3-month T-Bill would average 3.8 percent between 2011 and 2014).

Annotations reflect CBO projections for 3-month T-Bill. Data source: reports for 2009, 2010, 2011, 2012, 2013, 2014, and 2015.

In short, many expected that interest rates would be much higher by now. All the way back in 2009, the expectation was that short-term Treasurys would be yielding close to 4 percent by now. In early 2014, the CBO projected short-term bonds to be yielding 1.8 percent by 2016.

All of the CBO projections — which generally mirror the overall expectations — have badly missed the mark (as forecasts often do). And because interest rates have remained at near-zero levels, long-term bond ETFs such as have been surprisingly great investments. The table below summarizes the same data in a slightly different manner:

With a long-awaited rate hike perhaps finally in sight, the multi-year rally for long-term bond ETFs may be nearing an end. Then again, maybe not; interest rate futures indicate about a 3 percent chance that rates are unchanged from current levels in November 2016.

About the Author: Michael Johnston

Michael Johnston is senior analyst for ETF Reference, and also serves as COO of parent company Poseidon Financial. His investment expertise has been featured in The Wall Street Journal, Barron’s, and USA Today, among other publications. He resides in Chicago.

Comments