Written by Michael Johnston. Published January 4, 2016.

Building a portfolio customized to your goals and risk tolerance with ETFs can be as simple or complex as you want it to be. In our opinion, simpler is better. This final chapter of the Beginner’s Guide to ETFs will provide some basic guidelines for building a portfolio.

In this chapter:

- How can I beat the market?

- What asset classes should I include in my portfolio?

- Which portfolio is best for me?

- What are “all-in-one” ETFs, and are they right for me?

How can I beat the market?

In my opinion, this is the wrong question to be asking. Investors can (and do) attempt to beat the market, and many succeed in the short term. But there is a substantial amount of evidence indicating that consistently beating the market over the long term is very difficult.

One such piece of evidence is the annual SPIVA U.S. Scorecard report published by S&P Dow Jones Indices. This research includes data on the percentage of mutual funds that have underperformed their benchmark over periods of one, three, five, and ten years. Across all types of funds (i.e., large cap, mid cap, and small cap) very few funds consistently outperform their benchmark:

Data Source: S&P Dow Jones 2014 SPIVA Report.

The chart above shows that only 18 percent of large cap funds beat their benchmark over a ten-year period. Across other time periods and market cap ranges, the results are similar: some funds outperform each year, but most actively-managed funds fail to beat their benchmark.

Instead of asking how they can beat the market, most investors should be asking how they can minimize fees and taxes. The main killers of actual net portfolio returns are high fees and behavioral mistakes. Investors can beat almost all of their peers simply by holding a balanced portfolio that has low fees and by avoiding behavioral mistakes. Buying and holding low-cost ETFs for the long term is a winning strategy not because it beats the market, but because it replicates the market and avoids unnecessary expenses.

In buying ETFs that replicates the market, you are diversifying your portfolio — thereby eliminating unsystematic risk — while keeping costs low (as ETFs typically have much lower expense ratios than do actively managed mutual funds). By holding ETFs for the long term, you are able to avoid behavioral mistakes, which can often devastate returns. Again, you won’t beat the market with this strategy. But you will outperform the vast majority of those who pay for actively managed funds and/or trade regularly.

What asset classes should I include in my portfolio?

There are more than 1,700 ETFs available to U.S. investors covering several asset classes. While most ETFs hold stocks and bonds, there are some that invest in more exotic asset classes such as commodity futures, physical gold, real estate, and currencies.

For investors looking to build a long-term portfolio that features low costs and low turnover, simple stock and bond funds will often be sufficient. For those looking to make a tactical weighting towards a particular country, stock sector, or type of bond, more targeted ETFs may be useful.

The following sub-categories of ETFs will be most useful to those looking to build a long-term portfolio:

- Diversified Developed Market Stock ETFs

- Total US Stock Market ETFs

- Diversified Emerging Markets Stock ETFs

- Global Stock ETFs

- Total US Bond Market ETFs

Which portfolio is best for me?

The exact portfolio that makes sense for you depends on a number of factors, including your age, income, and tolerance for risk (i.e., how willing you are to endure big swings in value). Determining your risk tolerance and asset allocation strategy is one of the biggest investing decisions you will make.

While it’s impossible to present a customized portfolio without considering your individual circumstances, there are some popular portfolio models that can guide you. These model portfolios are all pretty similar, and are constructed entirely of stocks and bonds. More exotic asset classes such as commodities are unnecessary for the vast majority of investors, and as such are not considered in these models.

Some of the most common portfolio models are:

- 60/40 Portfolio: This is a relatively conservative portfolio, with 60 percent in equities and 40 percent in bonds. It may be appropriate for investors nearing retirement or those with a low risk tolerance. This portfolio could be accomplished with as few as two ETFs. For example, a 60 percent weight to the Schwab US Broad Market ETF (SCHB) and 40 percent weight to the Schwab US Aggregate Bond ETF (SCHZ). If you wanted to scale back risk even further, you could use the Vanguard S&P 500 ETF (VOO) instead of SCHB. If you wanted global stock exposure, you could use the Vanguard Total World Stock ETF (VT) instead.

- Age-in-Bonds Portfolio: Using this model, you would subtract your age from 100 and allocate that percentage of your portfolio to stocks. The remainder (i.e., your age) is allocated to bonds. Each year you rebalance, you shift your portfolio away from equities and into bonds, becoming more conservative as you age. This portfolio could also be implemented with the limited number of funds above.

- Three-Fund Portfolio: A three-fund portfolio has equal exposure to three asset classes: bonds, U.S. stocks, and international stocks. The result is a split of roughly 67 percent equities and 33 percent bonds. An implementation of this portfolio may consist of equal weights to VT, SCHZ, and the Vanguard Total International Stock ETF (VXUS).

Our advice is to pick one you like and can stick to over the long run. If you can keep costs low and avoid making major behavioral mistakes, you’ll beat most other investors.

What are “all-in-one” ETFs, and are they right for me?

It is possible to build an ETF portfolio that is even simpler than the models outlined above. There are a number of “all-in-one” ETFs that offer exposure to multiple asset classes. Given this strategy, it may be appropriate to allocate your entire portfolio to a single ETF.

For example, the iShares Moderate Allocation ETF (AOM) consists of the following asset classes:

- U.S. Bonds: 46 percent

- U.S. Stocks: 21 percent

- International Stocks: 18 percent

- International Bonds: 8 percent

- Other / Cash: 7 percent

Within each of these asset classes are diversified baskets of stocks and bonds. In other words, AOM effectively offers exposure to thousands of individual stocks and bonds. For those looking to allocate about 40 percent of their portfolio to stocks, it may make sense to own just one ETF.

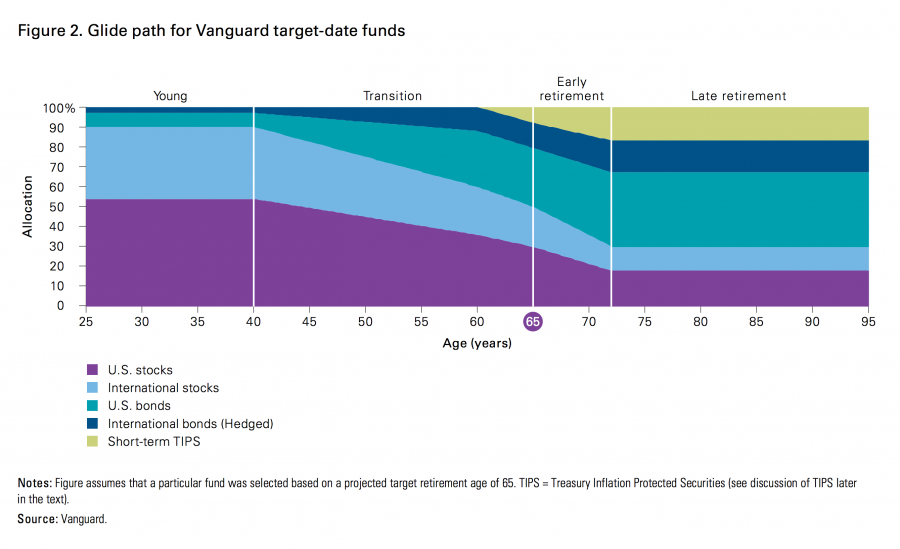

If you’re interested in this simplified approach to investing, however, target retirement date mutual funds may make more sense. Target date mutual funds adjust the weightings in stocks and bonds change automatically over time, reflecting the shift towards more conservative assets that should occur as investors age and retirement approaches. The “glide path” from Vanguard below illustrates how a portfolio may evolve from the time an investor starts saving up to and through their retirement.

If you think target retirement date funds might make sense for you, the Beginner’s Guide to Mutual Funds will be helpful.

This concludes The Beginner’s Guide to ETFs. If you missed any of our previous chapters, please refer to the table of contents below.

← Back to chapter 3 | Return to the beginning ↫