VIX ETPs attract interest whenever the market declines, but they aren't appropriate for most portfolios.

As the ETF universe has expanded beyond basic stocks and bonds, volatility is one of the asset classes that has opened up. But just because a strategy can be packaged into the exchange-traded wrapper does not mean it is appropriate for long-term investors. Volatility ETFs — with more than $1 billion in total assets — can be extremely useful for certain types of traders in certain situations. But for true investors, these products have nothing to offer.

The following chart shows the performance of VXX since it launched in early 2009, compared to the spot price of the VIX.

VXX has lost more than 99 percent of its value since it launched. The spot VIX is down over that period as well, but not nearly as much as VXX. The consistent and steep contango in VIX futures markets results in VXX lagging far behind a hypothetical spot return, and makes it unlikely that this fund will deliver positive returns over an extended period of time regardless of the severity of market declines.

Since VXX debuted, there have been a handful of similar products that aren’t impacted quite as substantially by contango at the front end of the VIX futures market. But even perfect exposure to the spot VIX — which, again, isn’t possible — wouldn’t be an attractive investment. The VIX may experience prolonged surges, but its long-term expected return is zero.

In other words, the index that VIX ETPs are likely to trail behind has an expected long-term return of zero. By comparison, stocks and bonds have positive expected returns. Each dollar invested in the S&P 500 in 1990 grew to nearly $10 by the end of 2014. Even investments in three-month Treasurys doubled over that time period.

It should be noted that VXX and other VIX ETPs generally accomplish their stated objectives quite efficiently. While these products simply aren’t designed to be long-term investments, they can be quite valuable as short-term hedges against stock market declines.

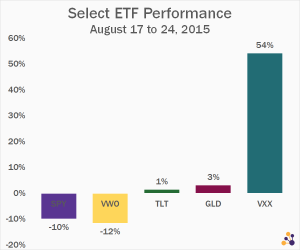

The following chart shows the performance for select ETFs between August 17 and August 24 of this year.

This environment is where VIX ETPs can add tremendous value. VXX surged as stock markets around the globe plunged, significantly outpacing more traditional safe havens such as long-term Treasurys (TLT) or gold (GLD). If stocks continue to slide, the VIX ETN could add to this stellar short-term performance. But over the long haul, consistent contango with an underlying zero-sum index will erode these gains entirely.

VIX ETPs can be great tools for betting on short-term chaos in the market. But if added to a long-term portfolio, they will almost certainly drag down performance.

About the Author: Michael Johnston

Michael Johnston is senior analyst for ETF Reference, and also serves as COO of parent company Poseidon Financial. His investment expertise has been featured in The Wall Street Journal, Barron’s, and USA Today, among other publications. He resides in Chicago.

Comments