Probably VOO.

In addition being the most widely-recognized stock benchmark in the world, the S&P 500 is also one of the most replicated. Hundreds of billions of dollars are invested in products that are designed to match the performance of the index, including dozens of mutual funds.

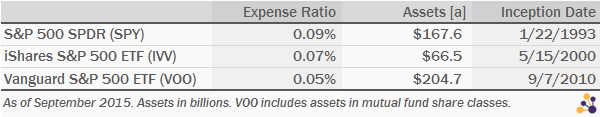

There are also three ETFs linked to the S&P 500: the S&P 500 SPDR (SPY), the iShares S&P 500 ETF (IVV), and the Vanguard S&P 500 ETF (VOO).

As with all indexed products, the expected return to investors will be equal to the return on the index less any management fees. In other words, the product with the lowest expense ratio will deliver the highest net return. In evaluating these three products, the decision becomes relatively easy:

All three are incredibly cheap — unlike many S&P 500 index mutual funds — but VOO is the cheapest. That makes it the most useful to those looking to include the S&P 500 as a core allocation in a long-term portfolio. Some investors with Fidelity accounts may find that the commission-free trading in IVV gives the iShares fund a lower “all-in” cost. SPY is well known and offers tremendous liquidity, but shouldn’t really be used in a long-term portfolio. It will consistently underperform both IVV and VOO.

Other S&P 500 ETFs

In addition to these three funds, there are a number of products that introduce twists on the S&P 500 — such as tweaking the stocks that are included or employing an alternative weighting methodology. These include:

- Guggenheim S&P 500 Equal Weight ETF (RSP): Instead of giving the largest weights to the most valuable companies, RSP gives a base weight of about 0.10 percent to each of the 500 components.

- PowerShares S&P 500 Low Volatility ETF (SPLV): This ETF consists of the 100 stocks in the S&P 500 with the lowest realized volatility over the last 12 months.

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL): This ETF holds components of the S&P 500 that have increased dividends for at least 25 years.

- PowerShares S&P 500 High Dividend ETF (SPHD): This ETF holds 50 of the S&P 500 that have historically had high dividend yields and low volatility.

- PowerShares S&P 500 High Quality ETF (SPHQ): This ETF holds the components of the S&P 500 that have the greatest long-term growth and stability of earnings and dividends.

- PowerShares S&P 500 BuyWrite ETF (PBP): This ETF holds a long position in the S&P 500 while selling covered calls on the index. This reduces the upside potential while generating additional income through the receipt of option premiums.

- PowerShares S&P 500 High Beta ETF (SPHB): This ETF consists of the 100 stocks in the S&P 500 with the highest beta over the last 12 months.

- Direxion S&P 500 Volatility Response ETF (VSPY): This ETF alternates its exposure between the S&P 500 and U.S. Treasurys based on measured stock market volatility.

- UBS ETRACS S&P 500 Gold Hedged ETN (SPGH): This ETN delivers the combined returns of investing equal dollar amounts in the S&P 500 and in short-term gold futures.

- SPDR S&P 500 Buyback ETF (SPYB): This ETF holds the S&P 500 components that have recently engaged in stock buybacks.

- Elkhorn S&P 500 Capital Expenditures ETF (CAPX): This ETF holds the 100 S&P 500 components that have the highest capex efficiency ratio.

There are also multiple ETFs offering exposure to the value and growth segments of the S&P 500. Each of these products is designed to perform well in certain environments or to potentially isolate attractive characteristics of stocks. They are all more expensive than the “plain vanilla” VOO and IVV, though they generally cost less than 50 basis points.

Investors looking for a specific type of tactical exposure may find these funds to be useful, but those building a long-term portfolio should prefer VOO.

About the Author: Michael Johnston

Michael Johnston is senior analyst for ETF Reference, and also serves as COO of parent company Poseidon Financial. His investment expertise has been featured in The Wall Street Journal, Barron’s, and USA Today, among other publications. He resides in Chicago.

Comments