Investors are their own worst enemy. But what does that actually mean?

“Investors are their own worst enemy.” I’ve read or heard this dozens of times. Usually I nod in agreement, and pat myself on the back for sidestepping a trap that seems to catch just about everyone else.

For a long time, I gave no thought to what this statement actually means, either in general or in the specific context of my portfolio. Then, I gave it a lot of thought. And after that, I distilled those thoughts into the 3,000 or so words below. (Don’t worry; there are plenty of images along the way.)

In short, I have been blissfully unaware of the many traits and inclinations that make investing so damn hard. Among others, I am: overly confident, stubborn, easily influenced (though I believe that I am not), and very, very risk averse. And none of these work in my favor.

Challenge #1: The ABCs

The ability to conduct objective, unbiased analysis is a key component of investing success. I had always assumed that executing on this idea — avoiding the external influences — is a relatively straightforward task. Just focus on what’s important, and don’t let biases impact my decisions.

But my brain is wired to constantly consider context, allow influence from external factors, and generally jump to conclusions. The following image, taken from Daniel Kahneman’s Thinking, Fast and Slow, gives a good example of this in action:

When I saw this, I read the left box as “ABC” and the right box as the numerical sequence “12 13 14.”

I didn’t realize what is now obvious: the middle character in both is exactly the same. My brain could have registered “A 13 C” or 12 B 14″ and been technically correct — but of course it didn’t. Instead it evaluated the character based on the surrounding information and made an automatic, split-second judgment.

This remarkable ability is, on the whole, a tremendous benefit. But it also demonstrates that I literally can’t read the alphabet without making unconscious decisions and allowing context to influence my interpretation of information.

When evaluating potential investments, I’ve always told myself that I was conducting unbiased, objective analysis. In reality, I was examining the relevant information but I was also taking in everything around it — the CEO’s appearance, a bearish headline I’d seen that morning, or a friend’s opinion. There has been a very direct and consistent result: where I should have seen two (or more) possibilities, I saw only one.

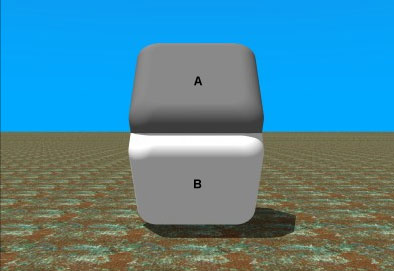

Challenge #2: Colors

The image to the right is another classic illusion. When asked to determine the relative colors of the sides marked as A and B, I immediately identified A as darker — much darker. They are, of course, actually the same color (once I put a finger over the area where the sides intersect, this became obvious). My brain was fooled by, among other things, its experience with shadows.

The image to the right is another classic illusion. When asked to determine the relative colors of the sides marked as A and B, I immediately identified A as darker — much darker. They are, of course, actually the same color (once I put a finger over the area where the sides intersect, this became obvious). My brain was fooled by, among other things, its experience with shadows.

This illusion revealed several shortcomings. First, my brain was tricked by past experiences into assuming that certain relationships held when presented with a new situation.

Perhaps more important, however, was my failure to take the relatively easy steps that would have led to the correct answer. Once I arrived at what seemed to be a logical answer — after glancing for all of a second — I considered the exercise complete. I could have thought about the situation for a few seconds, approached the image from a few different angles, and reached a (correct) decision that was the opposite of my initial conclusion.

I’ve done this on countless occasions when making investment decisions. I’ve arrived at the easy decisions — such as a bullish outlook on the emerging markets of China and India — after a lazy review of the evidence. I’ve picked out bond ETFs without really looking at what they hold because I was more interested in a quick answer than an optimal one. I found what seemed to be a good enough answer, and went with it.

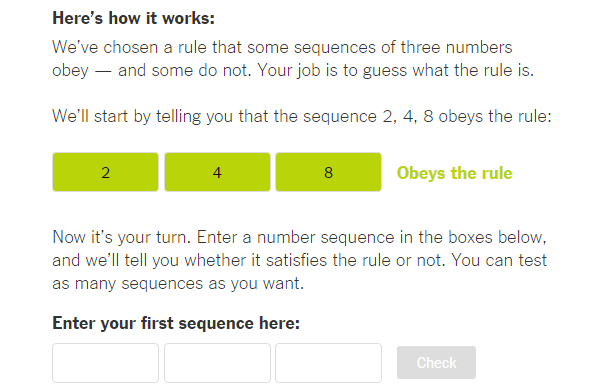

A better, more interactive demonstration of this tendency can be illustrated by playing the quick game below:

Challenge #3: Stubbornness

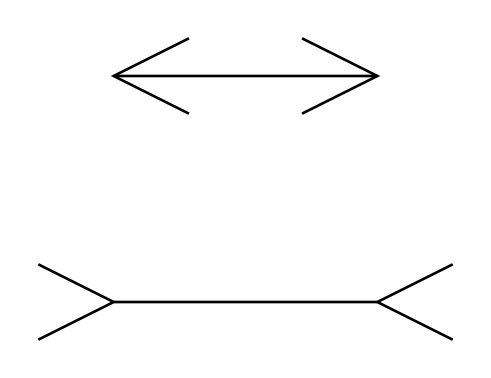

Consider the two lines shown to the right. By the time I saw this one, I could guess where it was going; the line in the bottom figure appears to be longer, but the two are actually the same size.

Consider the two lines shown to the right. By the time I saw this one, I could guess where it was going; the line in the bottom figure appears to be longer, but the two are actually the same size.

When I look at them again (or for the 100th time), the bottom one still looks longer — even though I know for a fact that it’s not. It has been proven to me beyond any possible doubt that the two are the same length. But my stubborn and easily fooled brain tells me otherwise. (I just looked again; that bottom line sure does look longer.)

I’ve experienced a similar feeling as an investor. I’ve known (or at least strongly suspected) that a sell-off is unwarranted, but reflexively panicked and sold anyways. It’s been proven to me that stock picking is futile (at least for someone of my abilities), but I can’t resist (more on this below).

I’ve made a few investments over the years that turned out to be real dogs. After consistently blowing projections and missing deadlines, I still saw huge potential whenever I thought about the stock. It had been demonstrated to me over and over that the investment was a loser — but my brain still saw a sparkling opportunity.

Challenge #4: Hunger

The optical illusions above are entertaining and hopefully a bit humbling. (I’ll spare you from additional examples.) But they are relatively meaningless exercises; I assumed that my brain is duped because there is nothing on the line (besides perhaps some personal pride). Surely I would avoid such basic traps when it matters.

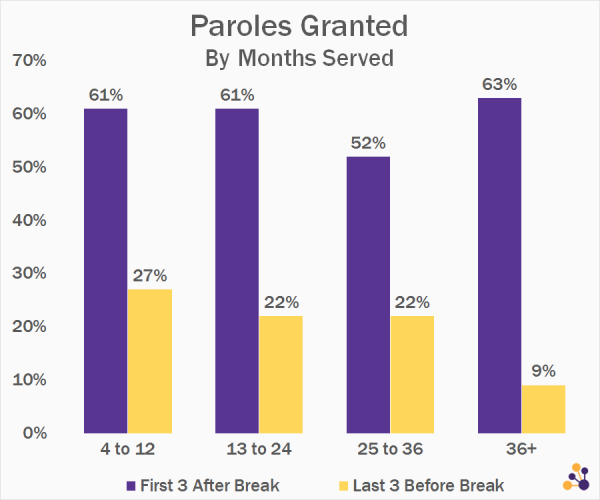

Several studies indicate otherwise. One notable project reviewed the decisions made by a group of experienced Israeli judges who considered parole requests all day. Twice a day, the judges took a break for food, which effectively segmented their period of work into three sessions.

Some predictable trends emerged when the data was reviewed; for example, those with no previous incarcerations were more likely to be granted parole. Some trends were not so predictable; most notably, the rates of parole varied significantly between the first three cases reviewed after a break and the last three reviewed before one.

These decisions weren’t quite life and death, but they were certainly meaningful. The judges made very different decisions — that had profound impacts on the lives of others — depending on whether they were hungry and fatigued or full and refreshed. I suspect an analysis of financial advisors would yield similar results; portfolios reviewed right before lunch may receive hasty judgments and allocations.

My own portfolio maintenance has undoubtedly been impacted by my mental state; I tend to tinker or rebalance in the evening after a long day of work or on the weekend when more enjoyable tasks await as soon as I finish. And, as a result, my decisions are probably impacted by my state of mind.

Challenge #5: Pretty Fonts

I like to think of myself as a perfectly rational being, whose decisions are immune to the impact of outside factors. But in reality, I am vulnerable to even the simplest of manipulations. Consider two statements:

- Theodore Roosevelt won the popular vote in all but five states in the 1900 election.

- Theodore Roosevelt won the popular vote in all but five states in the 1900 election.

These two statements are, of course, identical. They’re also false; Roosevelt was the candidate for vice president in 1900, and took over as president after William McKinley was killed. But I am more likely to believe statement #1, simply because of the font used. Similar studies have found that bold styling similarly increases trustworthiness, as does the clarity of the print or quality of the paper used.

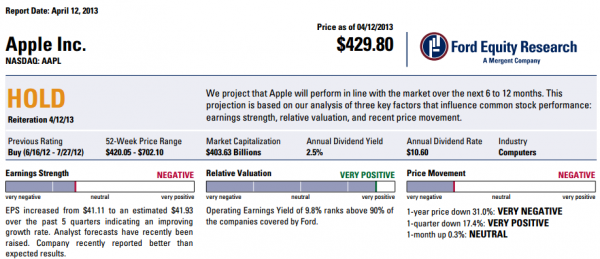

There are a number of applications of this vulnerability to investing. I am inclined to trust analyst reports — with their clean graphics, bright charts, and 40-point “Outperform” or “Hold” conclusion — much more than a thorough but detailed analysis on a random WordPress.com blog.

A “Hold” rating on AAPL in the spring of 2013 was, of course, not a great call. But this report sure makes it look compelling.

Challenge #6: TVs and Computers

While I initially resisted (and am still resisting) the idea that fonts or the timing of my lunch impact major decisions, I would concede that that the media I consume has some impact on my worldview. But I have generally believed the impact of the TV I watch or the web sites I read to be minimal.

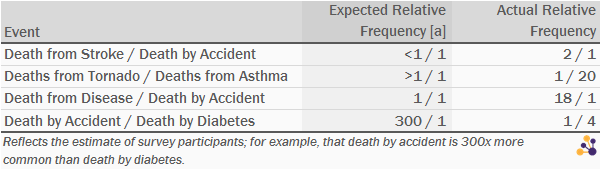

A study referenced in Thinking, Fast and Slow asked participants to gauge the relative likelihood of being killed by various events, such as a stroke, accident, or diabetes. Participants consistently overestimated the probability of the events that dominate news coverage (such as accidents and tornadoes) and underestimated the likelihood of death from “boring” causes such as disease.

Most notably, death resulting from an accident was estimated to be 300 times more likely than death from diabetes — which actually claims four times as many victims.

Again, this error in judgment has obvious extensions to investing. I am likely to have positive opinions about the stocks I hear mentioned over and over again, and not give much thought to the companies that receive no media coverage. I have an unrealized loss on Twitter (TWTR) as proof. My mom has asked for my opinion on Facebook (FB) and Apple (AAPL) stock but is yet to bring up Flowserve Corporation (FLS) or FMC Tecnhologies (FTI).

I’m easily spooked by the stories that dominate the headlines — China stands out as a recent example — but never consider more serious risk factors that receive little coverage.

Challenge #7: Self Assessment

After confronting much of this evidence, I told myself that others may be susceptible to subtle manipulations from changes to the font or the news cycle but that such factors wouldn’t ever impact my decision making. That probably isn’t the case; it’s much more likely that I suffer from illusory superiority.

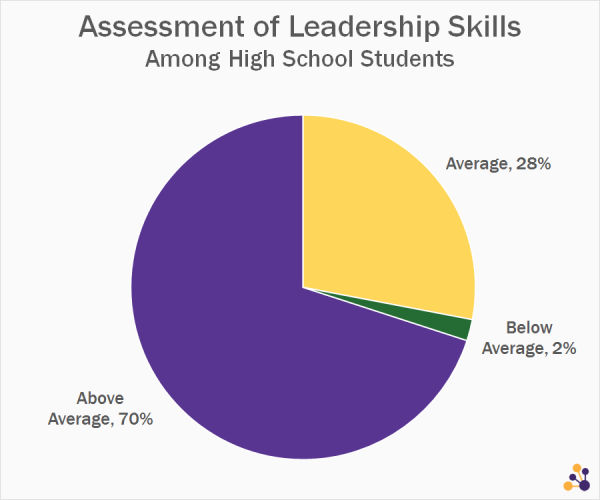

Countless studies have demonstrated that the majority of people judge themselves to be above average in a wide variety of categories ranging from driving ability to philanthropy. One classic study asked high school students to evaluate their leadership skills, and yielded the following results:

Data Source: College Board (1976-1977)

Other studies have shown similar results: motorcyclists believe they are less likely than the average biker to cause a crash (Rutter, Quine, and Albery, 1998); 94 percent of college professors give themselves an “above average” rating (Cross, 1977); and bungee jumpers believe they are less likely than the average jumper to experience an injury (Middleton, Harris, and Surman, 1996).

This tendency persists to an almost comical degree: participants in one study believed that they are more likely than their peers to provide accurate self-assessments (Pronin, Lin, and Ross, 2002).

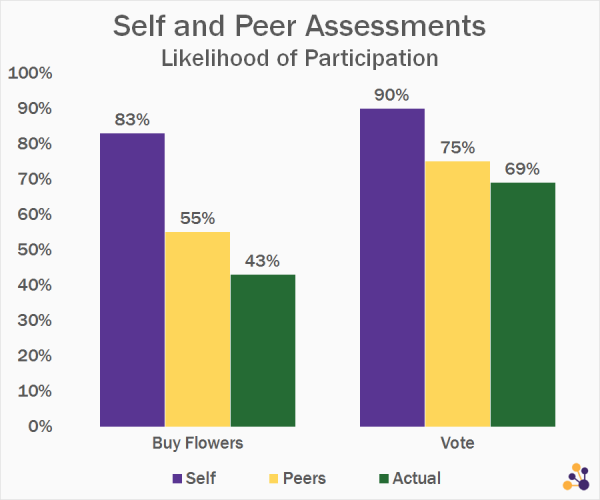

In another experiment, college students at Cornell were asked about an upcoming charity drive in which they could purchase flowers to benefit the American Cancer Society. More than 80 percent of the students predicted that they would buy flowers, but estimated that only 55 percent of their peers would. Similarly, 90 percent expected to vote in an upcoming election but expected only 75 percent of their peers to cast a ballot.

Actual participation was relatively easy to measure, so we have some amusing results.

The point of all these studies, of course, is that it is human nature to overestimate our own abilities. This has very clear ramifications for those who judge themselves to be superior stock pickers or asset allocators. (A 1998 study showed that stock pickers think their picks are more likely to be winners than those of the average investor.)

I have convinced myself several times that I am an above average stock picker (again, I have the TWTR position to prove it), that I knew when the markets were overvalued, and that I had generally superior insights. This idea of personal superiority is, of course, an illusion. And a costly one.

Challenge #8: Undeserved Optimism

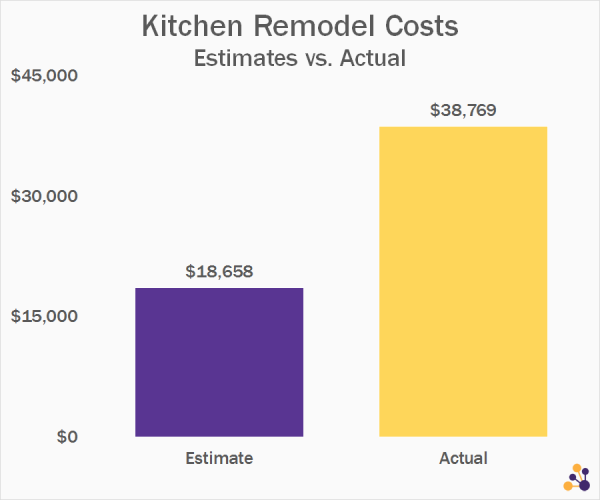

A 2002 survey referenced in Thinking, Fast and Slow asked homeowners to estimate the cost of remodeling their kitchen before the project began, and the followed up to tally the actual cost. The results revealed a tendency to dramatically underestimate costs (and, conversely, to overestimate benefits):

Data Source: Cost vs. Value 2002 Report

I am guilty of similar offenses; I chronically underestimate the amount of time to get from Point A to Point B (even when I make the same trip repeatedly). I have underestimated the cost of the last several vacations I’ve taken, even when I know that my previous estimates were low. I assume a best case scenario and ignore evidence that contradicts my desired result.

Applied to investing, this fallacy can have obvious (and undesirable) impacts. On many occasions, I’ve flipped through StockTwits commentary for a stock that I own (most recently RNDY). Each bullish perspective makes me more confident in my pick, but the bearish opinions are generally dismissed and swept aside. The bears must be jealous or confused; I would be foolish to put much stock in their opinions! But these RNDY bulls are really smart — good for them for getting in on this one!

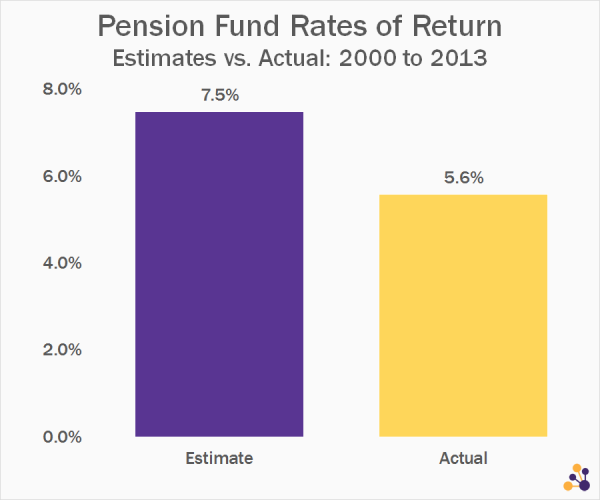

I have some well-heeled company as a victim of the planning fallacy; many pension funds are in dire straits as a result of decades of overly optimistic (and clearly unreasonable) expected rates of return:

Reflects aggregate data for largest 100 funds, which combined assets of $1.3 trillion. Data Source: Milliman

Challenge #9: Procrastination

It is human nature to procrastinate. This is nothing new. In most domains, procrastination is relatively harmless; I have experienced a miserable December 23rd at the mall and paid for a few subscriptions I no longer used, but the costs of doing so were minimal. In the domain of investing, however, procrastination can be very costly.

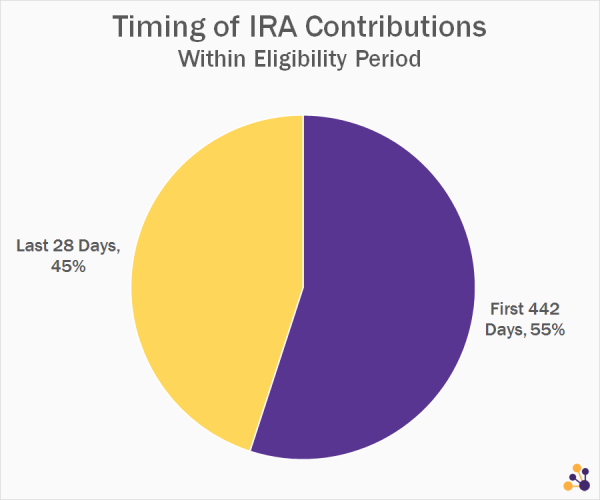

Perhaps the best illustration involves contributions to IRAs. The contribution period for each year actually lasts 470 days — from January 1 to the following April 15. According to Fidelity, the timing of these contributions — a key part of many retirement plans — breaks down as follows:

Almost half of contributions are made in the four weeks leading up to the deadline (and I suspect many of those come in the final week). This happens despite the fact that, over the course of a normal “saving period” timeline, there can be massive opportunity costs associated with sitting on the sidelines for those 442 days.

I have made several April 15 IRA contributions and waited months to roll over a 401(k) into a cheaper IRA, even through the effective hourly wage for doing so on time was likely well over $500.

Challenge #10: Statistics

One of the first books on investing I read was Burton Malkiel’s A Random Walk Down Wall Street. But I still struggle to incorporate a proper understanding of the concept of “random” into my tasks as an investor.

Assume that a coin would be tossed ten times, with each toss yielding heads or tails. Imagine three hypothetical outcomes for this series of tosses:

- HHHHHTTTTT

- HHHHHHHHHH

- THHTHTTHHH

When asked to identify the series most likely to be the result of a random toss, the third sequence jumped out as an obvious answer. The first two exhibit obvious patterns, while the third seems to be random. Of course, the probability of these three outcomes from a truly random series of tosses is exactly equal.

I have repeatedly confused random outcomes with skill. I have interpreted a series of winning stock picks as indicative of talent, rather than the toss of a coin. I’ve been blown away by the one mutual fund that beat the market five years in a row, even though this is relatively common (1 in 32 chance) if annual outperformance is perfectly random. I have been impressed by those who predicted major events (such as the 2008 crash) without questioning whether their prediction was a lucky one sandwiched between numerous losers.

Challenge #11: Risk Aversion

Several years ago, I learned about the concept of risk aversion in a Finance 101 class. When markets crumbled in 2008, I gained a deeper understanding of the concept. Hopefully a few simple hypothetical scenarios can enhance the textbook definition.

First, assume an opportunity to participate in a game with the following outcomes:

- If the coin lands on Heads, I receive $105; or

- If the coin lands on Tails, I lose $100.

My gut tells me to pass, even though a positive expected payout is easily calculated. Most survey participants are in the same boat, and would require the winning payout would need to be closer to $200 before they’ll take a toss. The number my gut comes up with isn’t too far off from that.

Another hypothetical scenario further illustrates my risk aversion; assume a choice between two options:

- 90 percent chance of winning $100, and 10 percent chance of winning nothing; or

- Guaranteed $85.

I’d take the $85, even though I know my expected payout is higher from the other choice. I’m spooked by the remote possibility of winning nothing and the regret I’d experience.

Think about my natural response to these propositions. In both cases, my reaction was to pick the option with the lower expected payout. The game is rigged in my favor, and I still choose to pass. I don’t like the idea of losing $100 or of having regret of missing out on $85.

This is a very simplified explanation for panic selling after a big drop in markets; I decide not to play the game with winning odds because I’m terrified of a big loss. Yet again, my natural wiring is in conflict with statistics and rational thought.

Challenges #12 to #100

I’ve probably simplified many of the examples above, and I’ve certainly only scratched the surface of my flaws as a human attempting to be a rational investor. But hopefully the general message has been conveyed, and my missteps will save you a few of your own.

After detailing my investing sins at length, I feel uniquely qualified to offer a bit of advice:

- Tune out the noise. There is a lot of crap out there. Ignoring it is much easier said than done, but it’s also incredibly rewarding.

- Read. In addition to the junk, there is a tremendous amount of quality information as well. The amount of time that the community at Bogleheads.org has spent offering thoughtful, free advice should single-handedly restore at least a bit of your faith in humanity. Jason Zweig’s archives are another free gold mine. Some other thoughtful professionals, in no particular order, include: Meb Faber, Morgan Housel, Noah Smith, Bill Schultheis, Ben Carlson, Bob Seawright, Patrick O’Shaughnessy, Tom Brakke, Michael Batnick, and Cullen Roche.

- Read…actual books. I started down the path of this article after finishing Thinking, Fast and Slow. I recommend that title specifically, but there is no shortage of worthwhile reads. Sometimes investing insights come from the most unexpected places. (The aforementioned Patrick O’Shaughnessy is a great source of recommendations, as is Meb Faber.) Warren Buffett estimates that he spends 80 percent of his work week reading and thinking; if he still has that much to learn, mere mortals might pick up a thing or to as well.

- Get help. I’ve generally been skeptical of the wealth management industry, but only because I know how it actually works. There are, of course, some exceptions to the rule in the form of truly excellent and honest advisors. I have a lot of respect for both Rick Ferri of Portfolio Solutions and the duo of Josh Brown and Barry Ritholtz at Ritholtz Wealth Management, as well as Cullen Roche and several of the other folks mentioned above. They probably aren’t personally immune from all of these flaws but have spent a lot of time developing systems that are.

I’d love to hear your thoughts and experiences; please continue the discussion below.

About the Author: Michael Johnston

Michael Johnston is senior analyst for ETF Reference, and also serves as COO of parent company Poseidon Financial. His investment expertise has been featured in The Wall Street Journal, Barron’s, and USA Today, among other publications. He resides in Chicago.

Comments